Hi, I’m James. Thanks for checking out Building Momentum: a newsletter to help startup founders and marketers accelerate SaaS growth through product marketing.

Get the next post in your inbox

Practical product marketing and GTM ideas, weekly.

I’ll start by saying I’m no pricing expert. But I have, as a product marketer at various companies of different stages, both been involved in and led pricing conversations… usually because nobody else has the experience. And you probably will (or have been) in the same situation.

I think it’s important that PMMs can work on pricing projects because of the obvious impact that it has on revenue.

But for those who haven’t had sight of pricing before, it’s a minefield. What, when, how, where, why?

In this post I’m going to walk through what a typical pricing project might look like for a standard B2B SaaS product. I don’t have a proper, academic approach – but I do focus on what I think is right, and what I’ve found works. As always, your mileage may vary – and if you’re following this process, remember that I write to give you inspiration, not instructions.

In this post:

Principles

Here are some principles I’ve tried to internalise that guide my approach and thinking around pricing.

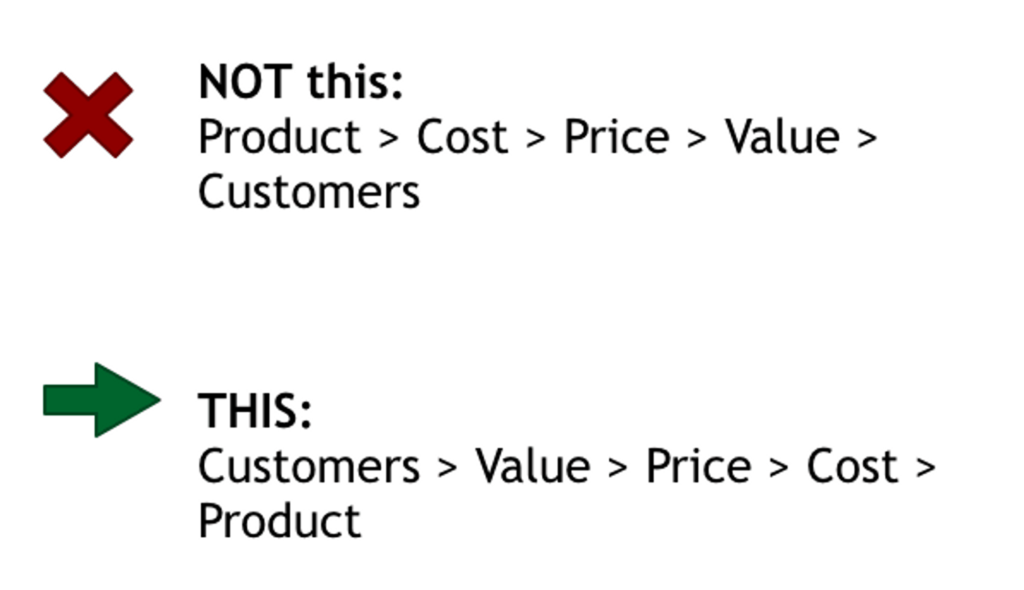

Price before product

If you’ve built your product and THEN decide what to charge for it, you’re wasting time and energy.

- Most startups will focus on the product first – the features it’s going to have, what it’s going to do

- Then, they’ll think about the cost – it’s taken us $X amount to build, or costs $Y to service

- They then use a cost-plus approach to set a price by adding an extra 50% – 80% margin

- They then look at the value that the product delivers, before working out what customers would be most interested

See how much riskier that is?!

Instead, smart startups will:

- Examine the market and select a group of customers to service

- Define the value those customers want to achieve

- Determine how much customers will pay to access a product that delivers that value

- Depending on the price customers will pay, plan how much they can spend to build/service, and set their own costs

- Finally, use the cost guidelines to develop the product

See how much more straightforward and rational that is? You’re more likely to hit gold earlier, rather than struggling to find traction.

Price problems are probably a positioning problem

“It’s not the price that people don’t like, but what they understand they are – or are not – getting for that price.”

That was the motto of a pricing consultant we worked with in a previous business and it’s stuck with me ever since.

All commerce is an exchange – value, for money.

- If your customers don’t understand the value your product delivers them, they’re unlikely to pay more money for it.

- If your customers believe your product delivers the value they need at a reasonable price, they’ll buy.

- If your customers think your product delivers more than the value they need at a bargain price, they’ll probably rip your hand off for it.

Pricing goes hand-in-hand with positioning.

Margin matters

In recent years gone by, how much profit you make when providing a product or service is usually here nor there – it was all about growth!

Not any more. Showing sustainable growth is crucial for sanity, let alone fundraising.

Analysing the COGS – cost of goods sold – means you can consider where pricing should be set so that it at least covers costs, if not deliver a 40% – 80% margin.

Process

Here’s what a typical pricing project might look like.

Set pricing objectives

Getting alignment on pricing objectives was actually one of the first posts I wrote about product marketing.

Your pricing is not going to exist in a vacuum. It does not exist for its own sake. It exists to support your business goals – so you should move forward with a clear understanding of what job the pricing is intended to do.

Pricing can be used to achieve many different objectives, from maximizing profit and growing market share, to reducing churn or discouraging new entrants.

You can download my pricing objectives process and template here.

Define your pricing strategy

Once you’ve agreed and discussed what pricing is expected to support, you can define your pricing strategy to support your objectives.

Your strategy should contain a review of the situation so far, the objectives set out, and then offer principles that will guide how you move forward.

There are a number of potential price strategies that you can choose from:

- Value-based pricing – determined by what customers will pay

- Competitive pricing – based on what competitors charge

- Price skimming – setting high pricing to capture demand from big spenders, then reducing pricing to capture lower layers of the market

- Cost-plus pricing – adding a margin on top of your costs

- Penetration pricing – offering attractive low prices to gain a foothold in the market

- Economy pricing – pricing low to build volume, so you can drive down costs through economies of scale

- Dynamic pricing – changing prices depending on demand

For example, you may build a strategy that is 70% penetration pricing and 30% cost-plus, with the intention of striking a balance between setting pricing low enough to be competitive – but enough to cover costs and contribute margin.

Note: we’re not talking about specific numbers yet.

Keep on customer research

Hopefully, you’re already working in lockstep with research underway to understand the market, segment them, identify the buying journey, buying group, personas, understand the value they desire, and more! This will help you to hit the ground running with strong inputs. Here’s my post on 19 customer development questions you should be asking.

The personas that you discover (don’t create them!) are going to be super useful to analyse the results from other research in this project. Understanding the value that they desire – and where they’re coming from, in the form of a value story – matters much more than the features they like.

Carry out specific pricing research

Once you’ve understood the personas that you want to sell to, now you can find people who fit those guidelines to three things:

- The ‘value metric’ they prefer to be charged by – seats, numbers of landing pages, number of customers, etc.

- Understand what features they value the most – to help you design the packages and pricing tiers you’ll offer

- Uncover how much they’ll be willing to pay for your product.

For context, I recommend reading the PriceIntelligently SaaS Pricing Strategy ebook and their blog post on value metrics here.

You’ll want to run a survey with four sections:

- Questions: Qualification info about them and their company – so you can match them against personas

- Questions: Value metrics – asking what is most important when it comes to pricing

- Questions: Feature preference analysis – asking which features are most and least important, so you can match up against personas to design packaging

- Description: Showcase your product with a landing page, product screenshots, or a demo video so your respondents can understand how your product is positioned and the value it delievrs

- Questions: Willingness to pay – asking for price points the respondent feels is too expensive, high but would consider, a bargain, too cheap

Here’s an example survey I captured in my Swipe File from Hiten Shah that walks through qualification, feature preference analysis, and WTP questions.

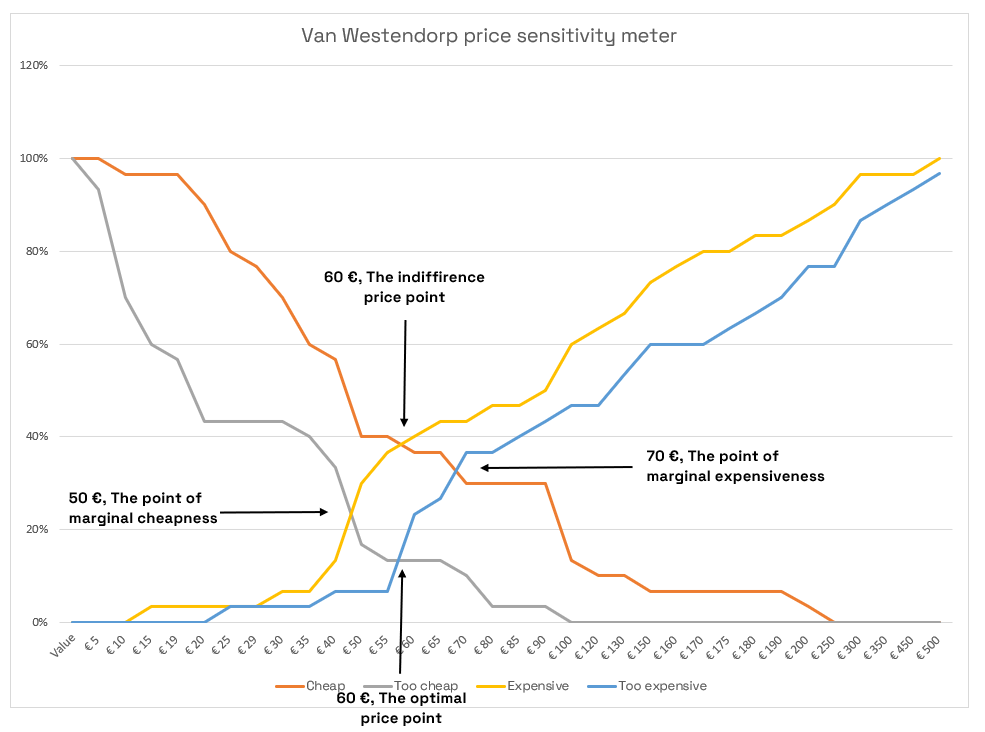

When it comes to the WTP analysis, you’ll need to carry out a Van Westerndorp analysis. Sounds complicated, right? It’s really not. Here’s a template – complete with walkthrough video! – that you can copy and follow.

The output is a graph like this that tells you the highest and lowest acceptable prices, and the optimal price point – where the most people think pricing is neither too cheap or too expensive.

Competitor research

At the same time, you’ll want to be understanding how your competitors… compare on pricing. You’ll want to look at a broad range of alternative solutions that customers can use to accomplish the same outcome and achieve the same value – because your biggest competitors are not who you think they are.

You’ll want to carry out general competitor research on their pricing tiers, positioning, product features – but don’t over-rotate on what competitors are doing. Rather than compete against competitors, we want to compete for customers – to be the ones who understand and service them best.

Draft and first review

If you’ve got this far, you’ve now acquired a ton of insight and understand what pricing needs to achieve for your business and the principles that will guide your pricing implementation, what your competitors are charging, plus:

- Your personas, the value they desire, etc.

- What customers think they should be charged against

- What features they think are most and least important

- The price points they think are too expensive, too cheap, and just right.

- All of the above, by specific segments and personas

Unfortunately there’s no quick and easy tips at this stage, except to say that it all has to go in the melting pot that is your consciousness to be considered, evaluated, analyzed, until you’ve come up with an initial perspective.

Your first draft is not going to be perfect, so don’t try too hard. Instead it should be a first checkpoint – a sanity check that you’re on the right path. If you’re in a typical SaaS business, you’ll probably create good/better/best pricing tiers.

Review it with the core stakeholders invested in pricing and ask for feedback and input. What works, what doesn’t work? What might be challenging?

Margin review and iterations

Once you have specific feedback on the direction, it’s time to check your margins and make sure you’re working towards something that will be long-term profitable for the business. You can find my post on creating a revenue model here to start working out your COGS.

With your finance team, understand what good margins look like for your business. A typical SaaS business will push for 70% margin, but this may be lower if you’re in an aggressive growth phase or higher if you’re moving into profit mode.

With these margins in mind, you’ll be able to iterate on your pricing draft and work in conjunction with the stakeholder group to improve. This might take one or two rounds… or might take more. What’s important is to continually revisit the pricing objectives that you have agreed at the start of the project. There’s nothing worse than the goalposts changing the game, or stress caused by misalignment.

Testing

I don’t mean A/B testing pricing on the website – you probably don’t have enough traffic to be statistically-significant, it’s difficult to track and follow through to purchase, and it may upset customers who bought at a higher price if you’re also testing a lower one.

Instead, test pricing in a similar way to how you might test positioning – alpha-test it with internal teams, beta-test it with friendly customers or in a cross-functional ‘tiger team’ to present pricing to real customers.

Generally, your pricing is going to exist in its form for around 6 months – long enough to get valid signals on effectiveness, and short-enough that it’s not going to create huge compounding problems. You’ll also want to think about the second-order effects of pricing: it may reduce the number of closed-won deals to begin with, but the customers that do buy may expand at faster rates to cover the gap and more.

Get approval

With all of this insight and feedback in mind, work with your stakeholders to get approval and final sign-off. Make it clear that pricing is an iterative process – it’s never one-and-done. You’ll want to build a plan to revisit and re-evaluate every three or six months to make sure you’re reacting to the market and setting yourselves up for success.

Implement

Depending on how your business is organized, this can be super easy… or super difficult. There’s no way to tell until you’re in the process either. Sorry!

Bringing it all together

Pricing is a beast. I highly recommend breaking it down into stages that work for your business, whether that means using the process outlined above, or adapting into whatever makes sense.

The principles, objectives, and strategy that you define will have a huge impact on the effectiveness of your pricing in action – so don’t skip the crucial conversations that need to happen to build alignment and level up your thinking.

Good luck!

Thanks for reading! Let me know what you thought – find me on Twitter and LinkedIn.

P.S: If you enjoyed this post, will you share Building Momentum with your network?