Positioning debt

Hi, I’m James. Thanks for checking out Building Momentum: a newsletter to help startup founders and marketers accelerate SaaS growth through product marketing.

SPONSORED

On Deck Founders (ODF) is an invite-only community for early-stage founders who want to find a co-founder, validate an idea, or build traction towards a fundraise.

The best reason to join ODF is to 10x your support network of other helpful founders. ODF founders have gone on to build 1,000+ companies valued over $9 Billion. Some examples include Levels, Secureframe and Pave.

—

Here’s what Vance Roush, co-founder of Overflow had to say:

“On Deck was catalytic in the earliest introductions to angel investors, giving us the momentum needed for later rounds of fundraising. Being around world-class people that are the best in the industry, and to be able to share knowledge was huge.”

Overflow raised a $10M Series A from R7 Partners — Limited spots available for the next cohort kicking off in early January.

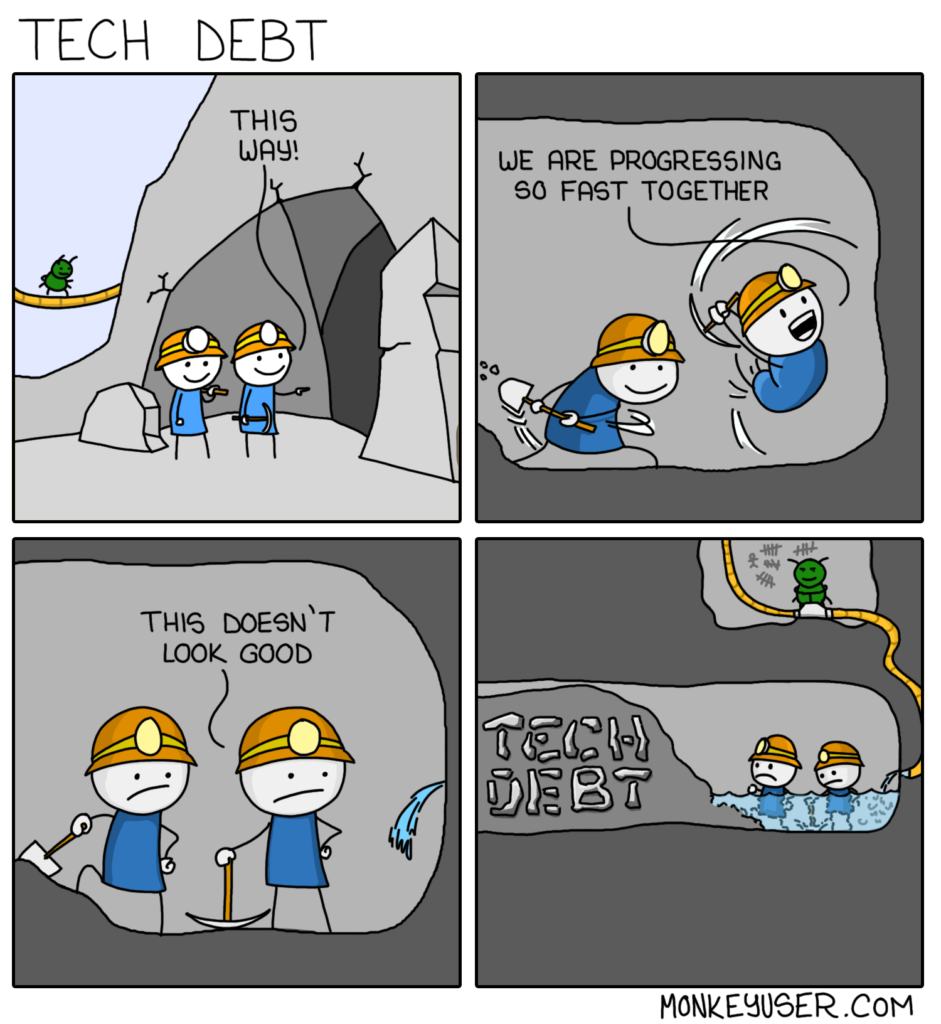

Do we all know what tech debt means?

“Technical debt… is the consequence of software development decisions that result in prioritizing speed or release over the [most] well-designed code… It is often the result of using quick fixes and patches rather than full-scale solutions.”

When something is created without thinking through the second-order implications – something that product marketers are good at – debt is created. You’ve solved today’s problem, but you just have a different problem in the future.

Just like real financial debt, you can borrow money – but in this case, it’s time. You can pay it off slowly – fixing things adhoc. Or you take the plunge to save and repay it all at once with a rewrite. But be careful – you’re borrowing future time. Spend too much without the ability to repay and you might go bankrupt.

And just like financial debt and tech debt, you can also incur positioning debt.

In this post:

Different types of positioning debt

In a number of different ways, quick fixes and patches to ‘fix’ positioning without proper consideration can definitely solve today’s problem, but present you more issues in the future.

Credit cards: Positioning to win a deal

Ah, the trusty credit card. I bet you’ve got many in your pocket.

Small, easy to use, always accepted – adapting your positioning to win a deal can really help turn a prospect into a customer.

Sure, maybe it’s only a small white lie (“We serve many enterprise customers!”) or just over-exaggerating features (“Yep, all automated, you don’t even have to click a button!”).

But it will only be a short while until the balance needs paying. Customer complaints. Churn. Bad G2 reviews. Product teams trying to build retention features, less focus on new biz priorities, and the house of cards starts to crumble.

Loans: Positioning for every campaign

Consistency in your positioning matters – probably more than you think it does.

If you’re creating new messaging for every campaign, you’re losing impact. Rather than having one message across all of your campaigns, you’re now attracting and winning customers on multiple different angles.

And at some point, you’ve got to pay the piper.

Say there’s a reactive campaign you created to scramble against a competitor’s news. At the same time, you’ve got thought leadership messages on a nascent angle you’re starting to explore. And your SDRs are using last quarters collateral with your ‘grow revenue’ messaging – but now the industry is in cost-saving mode.

Now you have to support at least three different strands across the go-to-market horizon. You can probably pay these back, a bit a time just like a loan, spread out over a few months or even longer.

But loans mean you don’t have the money/time to spend today, because of your prior commitments. And you don’t have any spare cash/hours, so it’s difficult to save for the next big spend.

Mortgages: Hasty repositioning projects

Repositioning your product and business is a lot like buying a house (stick with me here…!).

Every mortgage needs a downpayment. You can save for ages – in the case of positioning, by carrying out market research and getting ahead of the game. Or, you can move forward with the meagre minimum deposit, but not get the best results

Mortgages have valuations. If you’ve committed to positioning and then take it to market, you’re going to quickly find out whether it works or not. Do your research poorly and you’ll pay above market-value.

And are you sure you’re choosing the right house/positioning to begin with? What if you do it quickly, invest a lot of effort and time, but quickly outgrow it? Will you be stuck there, unable to move? Will you tack on extensions to your positioning, weird outhouses and follies that don’t match the style?

Just like mortgages, big positioning projects are affected by the economy too. Last year’s ‘invest in growth’ message can get wiped out in a matter of weeks as inflation and interest rates bite, with companies now favoring vendors with cost-efficiency messages. Can you quickly ‘re-mortgage’ without losing too much impact and finding worse terms?

Avoiding positioning debt

There are three things you can do to repay positioning debt and prevent getting there in the first place. Spoiler: it’s just positioning best practices.

Have a niche ideal customer profile that your entire business is aligned on building, marketing to, selling to, and supporting. This drives efficiencies and impact – but it does require hard conversations and discipline. You need to drive consistency.

In the early days while you’re still finding product/market-fit you have luxury to play around with positioning without much impact on your market perception. When you’re starting to scale and double-down, you have less wiggle room. This means you need more confidence in your positioning: that reality is going to meet expectations. You need to know how it’s going to perform, having tested and adapted it as necessary.

Lastly, building a constant pipeline of customer interviews, market research, and review will help you keep a pulse check on the market so you can react faster, adapt constantly, and look out for warning signs that you’re not keeping up with your debts.

Thanks for reading! Let me know what you thought – find me on Twitter and LinkedIn.

P.S. If you’ve found value in Building Momentum, could you buy me a coffee? Here’s my tip jar – any support is gratefully appreciated!

P.P.S: If you enjoyed this post, will you share Building Momentum with your network?